Identity fraud & AML checks for your clients

Verify your clients within minutes

A cutting edge digital identity verification solution

iDAML

Intelligent Onboarding

iDAML is a secure intelligent onboarding solution which helps you to onboard clients remotely without friction, in minutes.

Our Digital checks make sure your organisation meets the highest level of anti-money laundering compliance and due diligence.

Document Validation

Our solution can verify if the ID documentation is genuine or fraudulent by using Digital Tampering Detection software. Global coverage of over 800+ document types are covered (International Passports/EU ID Cards/UK Driving Licence).

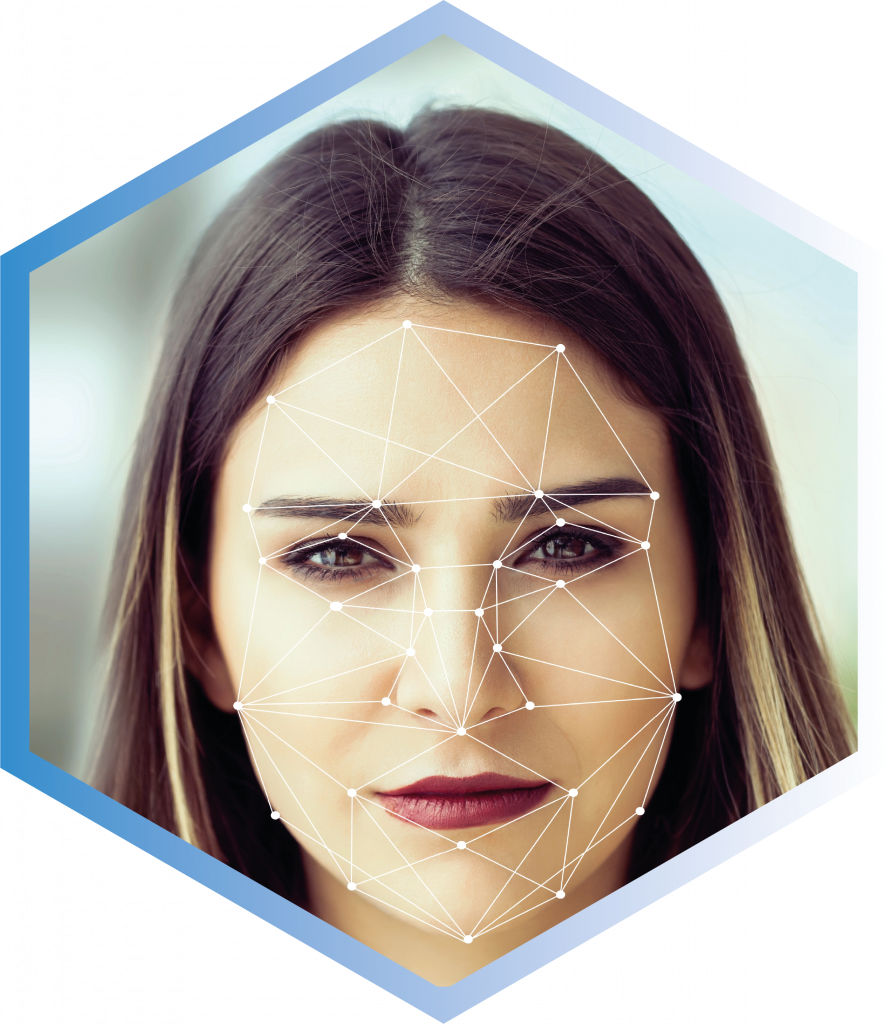

Face Biometrics

Using facial recognition, a 68-point scan of facial landmarks are used to match the client’s facial features taken from their ID document photo and their selfie photo.

Liveness Detection

Passive liveness detection confirms that the individual is an actual person in real time and not a fraudster impersonating someone else using a static image.

Identity Verification

Verifying the client’s name and address against multiple positive and negative databases will provide instant identity verification, giving your organisation the highest protection against fraud, terrorism funding and other unlawful financial activity.

Database Checks

Instantly cross-reference over 300 data sources to manage and mitigate risk including Credit Data, International PEPs and Sanctions Lists, Passport and European ID Cards, Electoral Roll, plus household and utility bills.

PEPs & Sanctions

Screening your client against global PEPs (Politically Exposed Persons) and Sanction watchlists makes sure your organisation complies with the latest Anti-Money Laundering (AML) regulations.

iDAML

Making your AML Compliance Easy

Our Anti-Money Laundering (AML) compliance solution is quick and simple to use for you and your clients. By simply sending an SMS web link from our iDAML platform, your client can remotely complete their identity and AML check within minutes, via their smartphone.

Once your client completes their identity and AML check remotely, you will receive the results within seconds.

Powered by:

iDAML

Streamline your client onboarding to just minutes

iDAML’s identity and AML check verification provides a fast and simple digital solution for organisations to onboard their clients electronically, without friction, in just a couple of minutes.

iDAML

Online anti-money laundering checks

Comply with the latest Anti-Money Laundering Regulations with an Electronic Money Laundering check. Be sure that your clients are who they say they are in a matter of seconds and streamline your client on-boarding and compliance procedures.

You could start making real financial and efficiency savings today with no financial outlay

Using our online anti-money laundering checks means:

Verify a client’s ID instantly

Make sure your client is who they say they are and meet your due diligence obligations by checking they are not engaged in any suspicious activity. Our AML checks screen against global PEPs and Sanction databases to give you the highest protection against terrorism funding, fraud and other unlawful financial activity.

Screen against 300+ sources

Instantly cross-reference over 300 data sources to manage and mitigate anti-money laundering risk, for an enhanced due diligence process. Our data includes: Credit Data, International PEPs and Sanctions Lists, Passport and European ID Cards, Electoral Roll, plus household and utility bills.

Ensure regulatory compliance

Our Anti-Money Laundering checks meet the standards outlined by the joint Money Laundering Steering Group (JMLSG) guidance, ensuring peace of mind that your due diligence is fully AML compliant. We will also protect your clients’ personal data in line with new Data Protection Regulations.

Contact us today to find out how

we can simplify your client onboarding

Request a

no obligation

free trial or demo

Select a time that is good for you